Positive

Reviews above 3.0 stars

Negative

Reviews below 3.0 stars

Average

Average of all reviews

Reviews

Total number of reviews

Reviewer opinions

Overview

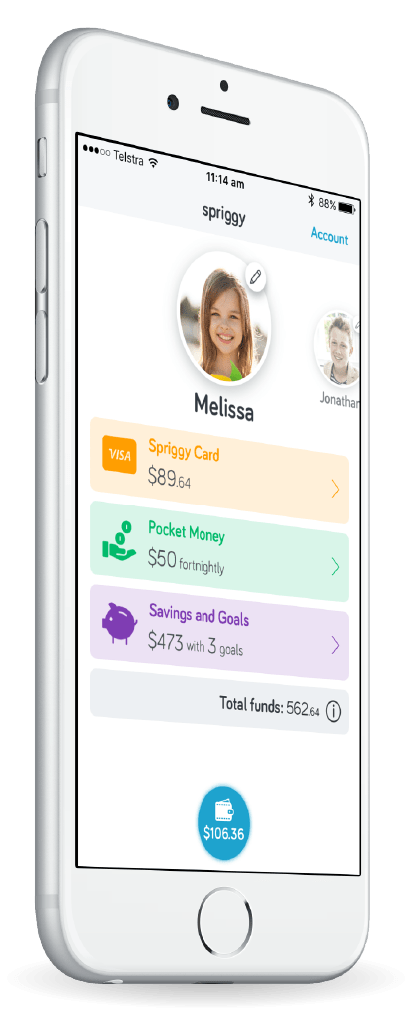

Spriggy is a way to start your child's financial education early, offering families a prepaid debit card for kids with a mobile banking app that parents and kids use together. Spriggy allows parents to follow their children's spending and teach kids how to save through savings goals. Cards can be locked at any time from the app and the card is limited to only pre-loaded funds. Kids get the freedom and independence to make their own spending and saving decisions while parents get the tools to help teach their kids about money.

Reviews

0

out of 5 starsScreenshots

Article coverage:

Key information

- Category

- General Information

- Budgeting

- Saving

- Life stage

- Starting Out

- Financial plan produced?

- Not Applicable

- Fee structure

- Subscription

- Is there a free trial?

- 1 Month

- Customer support

- Date founded

- 2015

- Company website

- Visit site

Start using Spriggy

How it works

Spriggy is a way to start your child's financial education early, offering families a prepaid debit card for kids with a mobile banking app that parents and kids use together. Spriggy allows parents to follow their children's spending and teach kids how to save through savings goals. Cards can be locked at any time from the app and the card is limited to only pre-loaded funds. Kids get the freedom and independence to make their own spending and saving decisions while parents get the tools to help teach their kids about money.

- Category

- General Information

- Budgeting

- Saving

- Type of help

- DIY Tool

- Where can I get this?

-

Online

App Store - Are there any other availability restrictions?

- Services Offered

-

- Will I learn what type of risk taker I am?

- Not Applicable

- Will it produce a financial plan?

- Not Applicable

- What types of investments are available?

- Not Applicable

- How many investment portfolio options are available?

- Where can I invest?

- Not Applicable

- Who manages my investments?

- Not Applicable

- In whose name are investments held?

- Not Applicable

- Is there professional research available on the investment options?

- Not Applicable

- Will it allow me to trade automatically?

- Not Applicable

- Will it automatically rebalance my portfolio?

- Not Applicable

- Will it provide reports on my investment performance?

- Not Applicable

- Cash management account

- Not Applicable

- Automated alerts and updates

- Yes

- Can I access other professional help through this service?

- No

- On which platform can I use this?

- Computer

- Tablet, Smartphone

- Account opening & closing

-

- How do I create an account?

- Online

- Account opening speed

- 5 minutes

- Will it capture my personal financial information automatically?

- Not Applicable

- Will I be asked questions about my situation?

- No

- How fast can I get my invested money back?

- Not Applicable

Who it's for

- Accessable by

- Myself

- Life stage

- Starting Out

- Type of customer

- Consumer

- Advice stage

- Define Where I Need Help

Define My Goals & Objectives

Assess My Financial Situation

Multiple Stages - What is the minimum amount I have to invest?

- No minimum

- What is the minimum amount I have to be earning?

- Not Applicable

- Customer service & support

-

- Is there general financial education information provided?

- Not Applicable

- Customer support

- Who do I complain to as a last resort?

- Not Applicable

What it costs

- Fee structure

- Subscription

- Minimum contract period

- Not Applicable

- Free Trial

- 1 Month

- Payment method

- Debit Card

- Credit Card

- EFT

Is it legitimate & secure

- Trading name

- Rivva Pty Ltd

- Who owns the company

- Not Available

- Who runs the business

- Mario Hasanakos, Alex Badran

- Date founded

- 2015

- Number of staff

- 2-10

- Security & Regulatory Compliance

-

- Will it verify my identity?

- Online

- Will it send me a confirmation security number to sign-up?

- No

- Are my records destroyed when I leave?

- Unknown

- Is there detailed documentation about the product?

- Not Applicable

- What company holds the financial license?

- Not Applicable

- Financial Services Guide?

- Not Applicable

Contact Information

- Website

- Visit website

- Send email

- Phone Number

- 1300 361 954

- Address

- Level 2, 50 Bridge Street, Sydney NSW 2000

- Social Media

Start using Spriggy

Start using Spriggy