Adviser Ratings has just released one of the most comprehensive studies available on the financial advice landscape in Australia in recent times. The report projects that around half of all advisers currently practicing will exit the industry in the next 5 years. As a result of this adviser exit, it is estimated that management of around $900 Billion worth of client funds will be overseen by a new adviser during that time. 5 years might seem like a long time, but if you are thinking of jumping into a relationship with an adviser,or already have a long term plan with your adviser and your relationship with your current adviser is important to you (and we know in most cases it is), it might be worthwhile having a chat with your adviser or intended adviser about their plans for the medium term.

Does Your Adviser Need To Get Qualified?

If you haven’t heard, one of the biggest reforms for the industry will involve the introduction of education and qualification standards that every practising adviser must adhere to. These changes are part of the drive to increase standards and professionalism in financial advice industry.

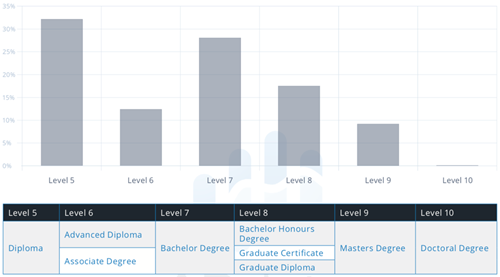

Fig. 1 Percentage of Advisers With Highest AQF Qualification Level Shown

Fig. 1 Percentage of Advisers With Highest AQF Qualification Level Shown

While all new advisers entering the industry will have to have a relevant bachelor’s degree (Australian Qualification Framework (AQF) – Level 7) from January 1, 2019 (just 7 months away), all existing advisers will have to meet the same requirement by Jan 1, 2024. Other factors that will impact adviser numbers include the Future of Financial Advice (FOFA) changes that have changes the way advisers gets paid, in many cases reducing their profitability and the current Royal Commission, the full implications of which are yet to play out.

Up To 50% May Exit The Industry Within 5 Years

In summary, 19% of the current market (advisers) is at direct risk of exiting, with this number increasing to 35-40% when factoring in FASEA requirements. The 35-40% figure is also a conservative estimate, and could potentially reach 50%, with many advisers with over 15 years of industry experience holding qualifications that are below the degree requirement.

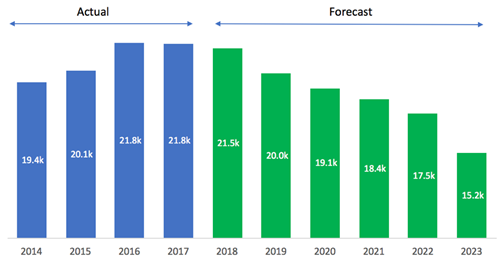

Adviser Ratings has spent a good part of 2018 evaluating the winners and losers that will come out of the regulatory changes from FOFA to FASEA, enforcement of education standards, nascent technology and adviser and consumer trends. When the UK went through similar structural changes based around the UK government's Retail Distribution Review (RDR), adviser numbers dropped from 40k to 30k in 4 years.

Fig. 2 Predicted Total Adviser Number Changes In The Next 5 Years

Fig. 2 Predicted Total Adviser Number Changes In The Next 5 Years

We will see something similar in Australia, a net decrease of 6k, with 14k existing advisers leaving the market (partly offset by new graduates and accountants entering the industry)

The report used information gathered from survey responses from over 1100 advisers, as well as looking at historical adviser movement data. We used this data and analysed current trends by going through adviser demographics, ranging from ages, experience and current qualification levels as well as overlaying this with adviser sentiment around selling their practices.

Right now, there is no doubt the advice industry is in a transformative phase. The changes taking place will not necessarily impact everybody who receives financial advice, but if you are a current client of a financial adviser or thinking about getting advice in the near future, you might be affected. If you want further clarity on this topic, it won’t hurt to ask a question or two during your next chat with your adviser.

Comments6

"So Why, John, M and Russ are the new standards requiring degree level qualifications? Just for shits and giggles? Just to look good for the public? Just to provide more income for education providers? Come on, whats the story. Are both sides of govt, industry and associations (all who agree on it) that dumb - or do a couple of blokes who've been in the game for a while know more than them? Seriously would like to know - is there some conspiracy going on here?"

Rob 14:10 on 29 May 18

"Rob, if you must ask that question, you do not know what a good risk specialist does! Risk insurance is not rocket science for a start and most advisers who specialise in this area have gained their knowledge over many years. I am a very dedicated adviser providing genuine, honest risk advice with no SOA fee. My business will have managed well over $10m in claims in the last 6 years. Ask my clients if I my service is professional. I do not need a degree to give honest, ethical advice and never will. This business is not about being an academic but a decent individual who cares for his clients. It is that simple and has worked for over 45 years! BTW Nga P, the changes will not make the industry accountable but decimate the number of genuine risk advisers and thousands of clients will not receive advice any more. Take note. "

Russ McConachy 17:48 on 28 May 18

"I agree with John. Speaking as a highly qualified advisor (even under the new regime) who joined the industry post FOFA and was highly experienced in finance before that, who has purchased a couple of (previously) largely non advised trail books over the past couple of years and started progressively converting them to FFS advised clients, I will financially have little choice but to exit the industry (at least for a while) if the government implements even half of what ASIC is proposing, as the equity destruction (irrespective of the cashflow side of things - which is probably manageable given a 3 year lead time) from re-valuing planning books to the same multiple as accounting fees (which is what it gets down to) is simply too large for our financiers (and ourselves) to accept without a substantial lead time. I know many of my peers who entered the industry at the same time are in the same situation and have similar thoughts. It is perhaps a reminder that it is the new breed advisors who have been professionalising the industry over the last few years that in many ways have the most to lose and most pressing incentives to get out before their equity is destroyed and they face financial ruin as a result of regulatory changes beyond their control. In the end, the lower end (fee wise) clients who are still advised at all will probably be being advised by fresh faced graduates in their mid 20's with little life experience and shallow industry knowledge probably without the experienced mentoring they need. I can't see how that ends well in the medium term for clients or the industry. "

M 15:21 on 28 May 18

"Rob, for the best part, a piece of paper saying you are 'qualified' is worthless anyway. Its time in the game that ultimately dictates an advisers worth. Or being 'street smart' as I call it. "

John Falcon 14:32 on 28 May 18

"Hi Rob, you make a fair call but, but advisers do much specialised ongoing training as well. The reforms that the industry are currently going through are to make the industry stronger, more professional and more accountable. Change is underway."

Nga P 14:17 on 28 May 18

"How can the industry claim to be a profession when half the advisers only have a Diploma as their highest qualification?"

Rob 14:07 on 28 May 18