February is typically a bustling period in the advice industry, as advisers work with both existing and new clients to devise practical strategies for achieving goals that clients may have been contemplating for a while. Regardless of the time of year, it's useful to see how financial advisers compare, across Australia, on key metrics such as fees, number of clients per adviser, and other metrics.

February is typically a bustling period in the advice industry, as advisers work with both existing and new clients to devise practical strategies for achieving goals that clients may have been contemplating for a while. Regardless of the time of year, it's useful to see how financial advisers compare, across Australia, on key metrics such as fees, number of clients per adviser, and other metrics.

With this in mind, we thought it might be useful to provide you with some facts and figures in a quick snapshot of some parts of the Australian advice industry, to help give you a rough baseline of what’s “normal”. The majority of this information represents some of the initial findings from Adviser Ratings’ recent survey of over 1000 Australian financial advisers. Please bear in mind that much of this analysis is based on averages and that there may be much divergence between individual advisers and their clients.

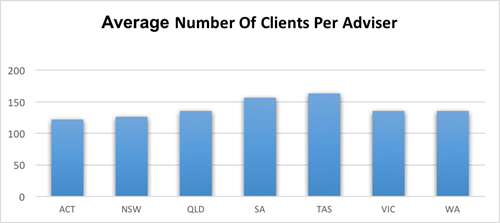

Number of Clients

Advisers and their practices come in all shapes and sizes. Some are individuals plying their trade by themselves or with a small support staff, others are part of large institutional organisations. Some advisers cap the number of clients they will service based on their capability to provide the level service they want to deliver to their clients. This could be based on many factors including specialisation of advice, experience, size of the advice practice and level of support the advisers receive.

Across Australia, on average Advisers service well over 100 clients each. Advisers from the ACT have the lowest average number of clients with 122, while Tasmania advisers service the highest number of clients on average – 164.

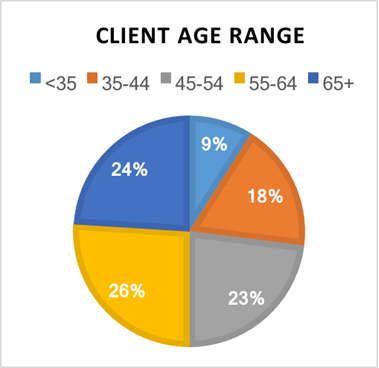

Client Age Range

For any of you thinking that advice is only for those nearing retirement, you may be surprised to learn that fully half of financial advice clients are under 55 years of age.

Many people already receiving advice will know the value of setting goals and putting in place a plan for their financial future. The earlier you can do this, the better as the benefits of savings will be compounded over time.

Pending Retirement

Doing this sooner rather than later will enable some to retire earlier than they had initially planned to. Our research also indicates that for those people receiving financial advice, 28% are retired, 29% plan to retire within 5 years and for 43% of clients, retirement is more than 5 years into the future.

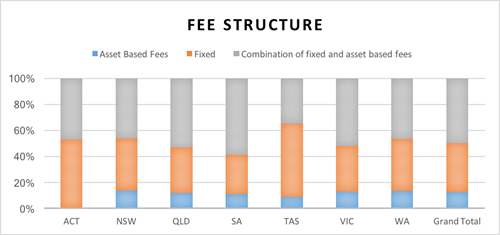

Fee Structure

An important aspect to consider when seeking a financial adviser is how the adviser will be remunerated. Fee structures can be different for different advisers. Advisers can be paid by taking asset based fees (typically a fraction of a percentage of funds under their management) or by having a fee for service model where you pay a fixed fee for a particular service that you want. Many advisers will accept a combination of these two types of payment, depending on the services you require. A state by state breakdown of the differing fee structures of advisers is below.

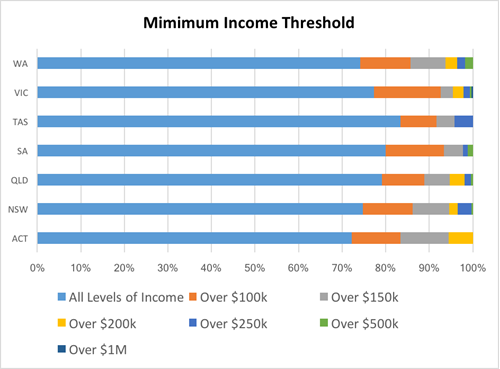

Minimum Income Threshold

While our research indicates that the vast majority of advisers are happy to offer their services to anyone seeking advice, some advisers have minimum thresholds regarding the type of client they are willing to service. For example, a small number of advisers cater to wealthy individuals known in the industry as “High Net Worth” (HNW) clients. Advisers who specialise in these clients will sometimes have a “minimum income threshold” that a client must meet prior to taking them on as a client.

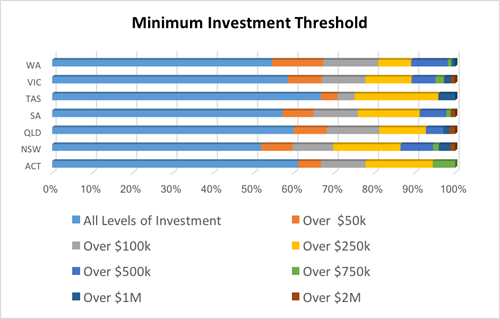

Minimum Investment Threshold

Similarly, advisers may specialise in different aspects of wealth generation and investment – as opposed to insurance and protection for example. These advisers may have a policy of a minimum investment threshold that their potential clients must meet, prior to them offering their services.

The key point for anyone to remember when they are looking for a financial adviser is to make sure you ask questions in your initial meeting. Be clear about what you are paying for and how the adviser is getting paid. Talk to the adviser about your financial goals what you want to achieve. Don’t be afraid of asking what you think might be “silly” questions. Advisers are at pains to point out that there are NO silly questions. They exist because they are experts at what they do and have the qualifications, experience and support that many people do not.

It is important that you are comfortable with your adviser because in many cases you will be talking to them about most aspects of your financial life and you need to feel secure enough in the relationship with your adviser to be able to do so.

Article by:

Comments8

"This picture turns the other way as the banks heavily scrutinize the business model and projected growth and profitability of the practice. The survey, which has been one of the longest running snapshot of financial planning industry in Australia, found that a similar number. https://www.marketing-lists-direct.com/"

Kevin Deeb 17:20 on 29 Jan 22

"What a load of lies. Averages. Advisers are getting paid from institutional organisations with out giving any advise. eg - Super companies. Everyone put the first lot of question on your list. What type of car do they drive and own? What investments to THEY have for their future? Are they renting and why? Do they have a mortgage and plan to have more? If an adviser is any good. They should be able to show and prove some sort of track record. Instead of going to work and a computer program telling them to buy or sell."

Scott Robert Wallace 11:07 on 24 Feb 18

"Hi Ernie - unfortunately we didn’t have enough respondents in NT to be statistically reliable."

Adviser Ratings 10:30 on 17 Feb 18

"Northern Territory , left out ? mistake?."

ernie underwood 10:16 on 17 Feb 18

"To Peter Fysh . . . "deadline looming in 2020 ??? what's happening in 2020? The qualification date is 2024. 'Please explain Pauline' as I'm very interested to hear if I am missing something."

Brian Howard 18:36 on 16 Feb 18

"To Peter Fysh . . . "deadline looming in 2020 ??? what's happening in 2020? The qualification date is 2024. 'Please explain Pauline' as I'm very interested to hear if I am missing something."

Brian Howard 18:35 on 16 Feb 18

"Whilst the average number of active clients managed per adviser is around 100, reality is many advisers also have large numbers of "legacy" clients that are not actively serviced. The issue for those advisers looking to sell their business is what value is attached to these clients, the reality being, willing buyers are not prepared to acquire these. Advisers could do well to address this as part of their succession planning sooner rather than later, particularly those with a 2020 deadline looming! Peter Fysh"

Peter Fysh 16:07 on 16 Feb 18

"Interesting. Looking forward to seeing more detailed insights from the survey."

Gavin R 15:11 on 16 Feb 18