I am in my mid 30s and have under $100K in super. If I withdrew $10K of super during the COVID-19 crisis, how could I invest it?

Top answer provided by:

Scott Malcolm

When it comes to all financial decision making it is about the context of what you are trying to achieve. I often say to clients that having a financial plan is purely about a decision-making framework around your money.

Under the COVID-19 Early Release of Super rules, you need to ensure your eligibility for access. These include losing your job, reduction of work hours (20% or more) or reduction of turnover if you are self-employed (20% or more). The intent of these provisions is to support and assist people who are facing financial hardship. So with regards to your question, if you are only looking for alternative investment options, and are not facing hardship, this may not be the most ideal approach. When it comes to moving money from one strategy and investment approach to another, it is all about the opportunity cost and the context of what outcomes you are wanting to gain at the end of the day.

Superannuation, although you cannot access the benefit of this until age 60, is a tax-advantaged investment strategy. If your outcome is for longer-term financial security, you should ensure that any early access under the COVID19 compassionate claims is aligned. If you are not happy with how your super fund has been performing, the fees you are paying or how much control you have around investment decision making. It may be time to review the superannuation solution rather than pulling the funds from your account.

When we are talking about an investment of $10,000, superannuation funds generally have access to the same types of investment opportunities that you can use outside of super. Investment into Australian Shares, International Shares or listed or unlisted property investment options all fall into the growth category of investment. With $10,000 invested personally, there are a range of exchange-traded funds or managed investments which may align to your risk tolerance, investment values and overall strategic approach. Again before you start investing it is important to be clear on what your outcomes are.

The Money Smart website and ASX website have some great resources which you can use to upskill about the different investment options that are available to you. Before you remove any funds from super be aware of the opportunity cost. Check how your current funds are performing and what fees you are paying and compare these to the alternative approach you are looking at. In the investment world, we often look in the rear-view mirror to see how things have performed over time. We do this to try and predict what the future may hold. This isn’t an exact science, as you also have to consider what things might be happening in the current environment. However, if you can get a longer than 10-year history this gives you a good timeframe to look back on. To see how well, or how poorly someone has managed money. This timeframe also includes various market climates such as the last Global Financial Crisis.

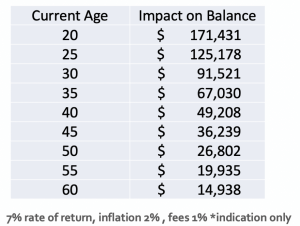

Moving from Super to personal investment you are not only moving from a tax-advantaged investment strategy, you are also removing money from your future retirement life. The table below shows the impact on taking $10,000 of funds based on various ages and an assumed 7% rate of return assuming a retirement age of 65.

IMPACT OF SUPERANNUATION WITHDRAWAL

So as with all financial decisions, before you take any action you should consider the context of your decision making. Seek out further advice, educate and empower yourself around the money in your life and start your journey to being free around your money.

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0