The RBA announcement yesterday keeping interest rates at a record low is another sign of the times: our new world of fragile post-COVID-19 growth recovery, small businesses struggling to stay afloat, and big businesses launching major redundancy programs while freezing new hires, pay rises and promotions.

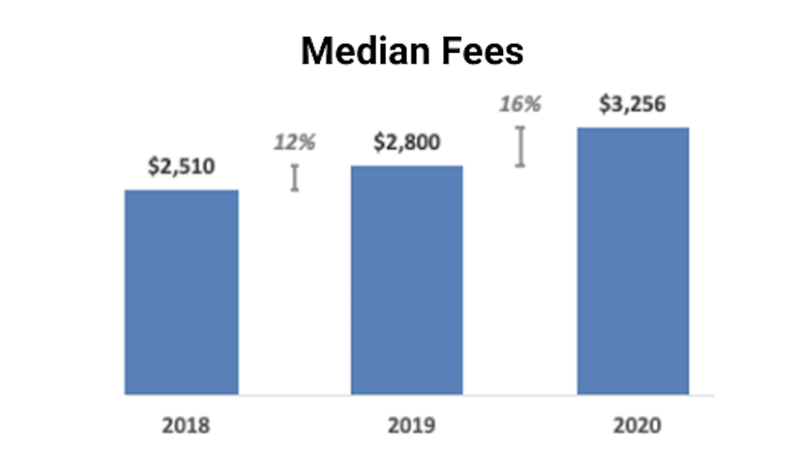

And yet from our recent 2020 Financial Advice Landscape benchmarking study, advisers are raising their median fees by 16% according to Figure 1. This was the exclusive focus of an article by John Collett in the Sydney Morning Herald and The Age today.

Figure 1 – Median Advice Fee Increases 2018-2020

Source: 2020 Financial Advice Benchmarking Study (n=1,500)

Of course, journalists don’t always have the space and the editorial control to provide fulsome explanations, or the desire to complicate matters for their consumer audience. This SMH article is no different in many ways – whereas we in the industry appreciate that there are multiple variables in play when it comes to determining client fees.

Other reasons for the higher fees, aside from rising costs and the shrinking supply of advisers, is because advisers are getting better at understanding their client value proposition and charging appropriately. This includes specialising in certain areas of advice, only engaging clients that meet their brief, and being better at articulating the value they bring, especially where it involves the softer elements of coaching and managing client impulse control rather than the hard metrics of portfolio performance. This is clearly coming through in the feedback we are receiving from advisers.

Perversely, this is coming at a time when the government is trying to remove red tape to reduce the overall cost of (simple) advice and encourage more consumers to seek it. However, there does not appear to be a lot of appetite from advisers to make wholesale changes to their businesses to provide simple advice in greater scale, despite the community need/demand. Partly, that is simply two groups (government & regulators versus the industry) running at different speeds on the same agenda. But, for now, advisers (and their licensees) aren’t prepared to take the risks to deliver more advice more simply, and more simple advice. At least not until there is more legal certainty about the direction the government is heading and that ASIC will not retrospectively hold them to account.

Going back to the rising fees question, there are still more variables to consider. What impact has changing client mix had on the outcomes, with potentially a greater proportion of transition-to-retirement work raising the scope and cost of individual engagements? What impact is the mix of retail versus sophisticated clients having on these numbers? What impact from one-off versus recurring clients. The answers rest in the data and rest assured we will uncover these insights in coming newsletters.

Article by:

Comments2

"Daniel, you're absolutely right. Another factor that is coming through in the data, particularly from practice owners. Thanks for pointing that out. "

Mark Hoven 21:00 on 03 Feb 21

"I'd argue another contributing factor for the average fee to have increased is the culling of unprofitable clients from advisers' businesses. Unfortunately due to the upward pressure on the cost to deliver advice, many advice businesses now find it unsustainable to retain clients with skinnier margins and absorb the losses they used to on these clients, and have had to make the difficult decision to not offer their services."

Daniel 15:31 on 03 Feb 21